Fun with Tariffs

Tariffs are a tax on the domestic consumers

Mr Trump has announced an increase in tariffs on 185 countries.

Who is affected by this round of US tariffs?

There are some problematic “countries”. For example, a 10 percent baseline tariff on Heard and McDonald Islands in the Antarctic Indian Ocean. The only permanent residents there are penguins.

Similarly, a 10 percent baseline tariff is imposed on the British Indian Ocean Territory. It includes the famous US base of Diego Garcia. It is a tariffs to be paid by the US military.

Executive conclusion: They make no sense.

Who pays for the tariffs?

If an importing country imposes a dollar’s worth of tariffs, the consumers of the importing country will pay (almost all) for it. The exporting country does not sit still. It usually imposes a retaliatory tariff of (roughly) the same magnitude.

The current US plan starts at 10 percent for all nations but rises higher for a bewildering array of trade partners – including 34 percent for China, 20 percent for the EU and 26 percent for India. French Guiana has a 10 percent base rate. There is one problem with this: French Guiana is an overseas territory of France - hence it *is* a part of the EU. The logical action by the EU would be to funnel all their exports through French Guiana and cut the tariffs by half!

Historical Tariffs

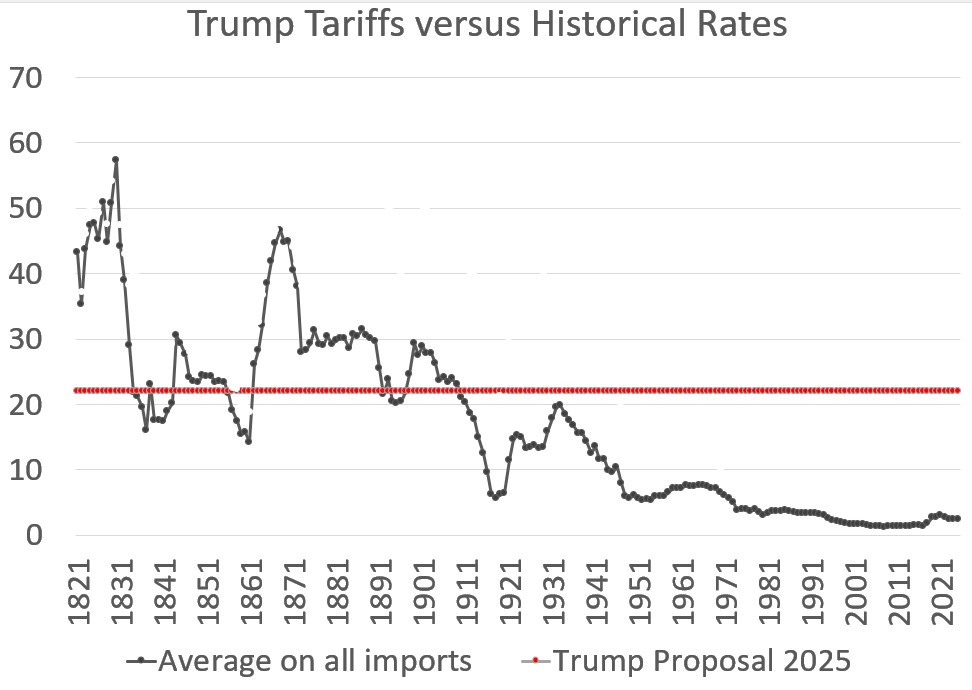

Depending on the total exports of a country, a trade weighted average of the tariffs can be calculated. In the past, the US has had relatively high tariffs - especially in the 19th century. The common argument was to protect the “infant industry”. Historically, whenever an industry got protection, it stayed an infant indefinitely. There was no incentive to increase efficiency.

If we compare the proposed rates with historic figures (adjusting for trade volumes across the globe), we get the following picture.

Executive result: To match the current average tariff rate for all goods, we have to go back to 1910. Thus, this is the highest tariff rate in over a century.

What impact will it have in the US domestically?

A worst-case scenario outlined by Moody’s sees 20 percent tariffs causing unemployment to peak at 7.3 percent in early 2027, from 4.1 percent in February, with stock markets declining by one-quarter over the same period.

What about the impact on consumers?

This depends on what other countries do. There are two extreme possibilities.

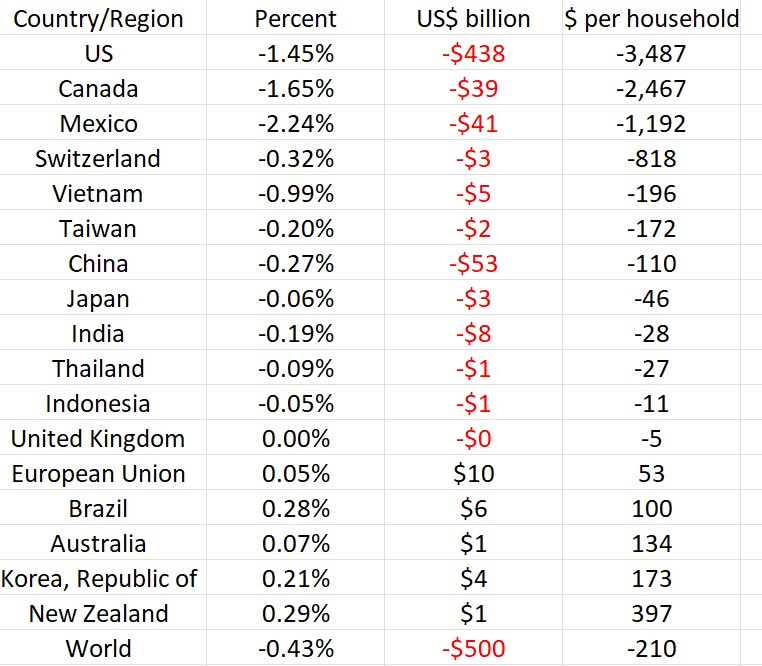

(1) Other countries impose a tit-for-tat policy. Computable General Equilibrium models show the impact. The biggest loser is the US both in total as well as on a per household basis.

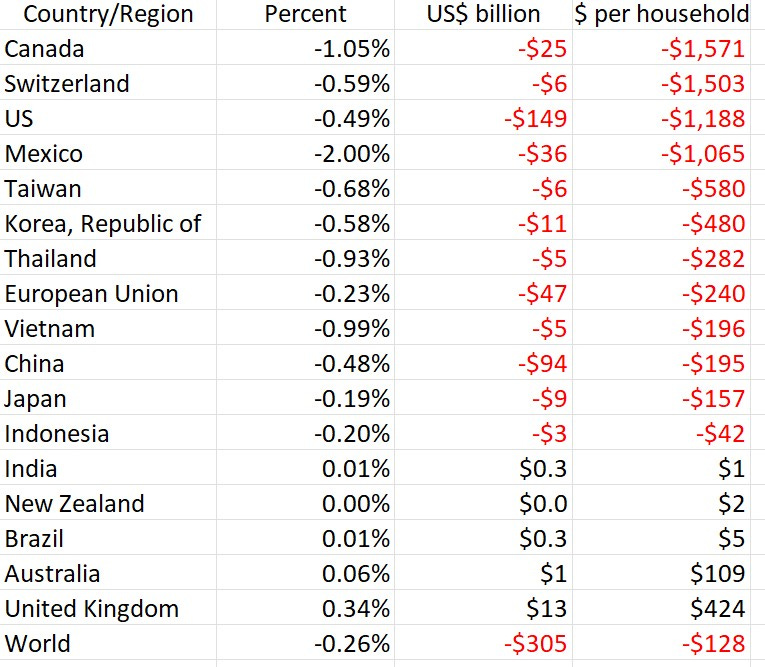

(2) Other countries do nothing. Steve Bessent, the Treasury Secretary said: "My advice to every country right now is do not retaliate. Sit back, take it in, let's see how it goes." Will they do that? For some countries, it might be the best thing to do. Here is the CGE model calculations for that.

Executive results: For some countries, it is advantageous *not* to retaliate. Globally, no retaliation produces less harm. But, it is country specific. Some losers become winners, some winners become losers.

Who sets the tariffs in the US?

It is usually set by the US Congress. This tariff announcement was made through an Executive Order of the President. It is not binding.

Executive observation: If the US Congress wants, it can completely nullify the Executive Order tomorrow. Whether it chooses to do that with a Republican majority is unclear.

Can Tariffs Generate Big Bucks?

Historically, tariffs have not generated more than 2 percent of government revenue. The US imports over 3 trillion dollars worth a year. If a tariff rate of 50 percent is imposed, would it generate 1.5 trillion dollars for the government? The answer is no because a rise in price will lead people to cut down on how much they buy.

Executive result: Under the best case scenario, the government will not be able to finance the proposed income tax cut by replacing it with tariffs.